The "Free" Partnership Fallacy

It starts with a handshake. Maybe it’s at a conference, or over a Zoom call that went surprisingly well. You’re a Director of Business Development, and you’ve just found a partner that seems perfect. They have the audience you want; you have the tech they need.

"We don't need to complicate this with a contract or cash," they say. "Let's just do a swap. We'll integrate your API, and you give us access to your premium data tier. A simple barter."

It sounds like the ultimate win-win. No budget approvals, no procurement red tape, just pure synergy. You sign the deal—or perhaps just agree in an email—and high-five your team. You’ve just secured a strategic alliance for zero cost.

Six months later, you’re staring at what I call a "Zombie Partnership".

Your engineering team is bogged down, spending 20 hours a week fixing bugs in the partner’s integration. Your product roadmap is delayed because resources are being siphoned off to support a "free" deal. And the marketing leads you were promised? They’re non-existent, or worse, they’re low-quality traffic that’s muddying your attribution data.

The deal wasn't free. It was expensive. You just paid for it in "Technical Debt" instead of dollars.

This scenario is painfully common. Research shows that 60-70% of strategic alliances fail, primarily due to "unequal commitment levels" and hidden agendas where one side eventually realizes the deal is lopsided. The problem isn't the partnership itself; it's the lack of a valuation framework.

When cash changes hands, we have invoices and audits. When value changes hands in non-monetary partnership agreements, we often fly blind. We trade "invisible" assets—data integrity, engineering time, brand equity—without ever calculating an exchange rate.

It’s time to stop trading blind. Throughout my career, from managing strategic partnerships at JCDecaux to leading technical integrations at Perion, I’ve learned that a partnership without a currency of exchange isn’t a partnership; it’s a gamble. To win, you need a concrete formula to value the effort.

Defining the "Give-to-Get" Ratio

The biggest mistake leaders make in soft partnerships is relying on "trust" as their ledger. Trust is essential for the relationship, but it is a terrible metric for operations. You need a hard score for your soft assets.

I developed the "Give-to-Get" Ratio to solve this problem. It’s a mathematical framework designed to model the fair value exchange in deals where no invoice is ever sent.

The formula looks like this:

Partnership Value = Tangible Assets (Data/Leads) + Intangible Assets (Brand Halo)/Technical Debt} + Opportunity Cost

Let’s break down the components, because the nuance is where the profit—or the loss—hides.

The Numerator: What You GET

This is the value flowing into your organization. Most people stop at "Reach" (how many people will see us?), but that’s a vanity metric. You need to look deeper.

Audience Quality & Product Focus Ratio: It’s not just about the size of their list; it’s about the overlap. Is their audience actually new to you, or are you just remarketing to people you already own? More importantly, does their audience care about your specific product? I call this the "Product Focus Ratio". A million eyeballs are worthless if they’re looking in the wrong direction.

Brand Transfer (The Halo Effect): This is the intangible value of associating with a "Tier 1" partner. During my time working with luxury brands like Movado, I saw firsthand that who you stand next to matters. If a small tech startup partners with a massive legacy brand, the startup gets a "trust transfer" that creates legitimacy. That legitimacy has a dollar value—it lowers customer acquisition costs (CAC) and shortens sales cycles.

Tech Stickiness: Integrations reduce churn. Period. If a customer uses your product inside a partner’s dashboard, they are far less likely to leave. The value here is calculated by the increase in Lifetime Value (LTV) multiplied by the Shared Customer Count.

The Denominator: What You GIVE

This is the cost side of the equation, and it is almost always underestimated in non-revenue deals.

Technical Debt: Maintaining an API connection isn't a one-time build; it’s a mortgage. APIs break. They update. They require security patches. If you commit to an integration, you are committing future engineering hours that could have been spent on your core product.

Opportunity Cost: Every hour your team spends enabling a partner is an hour they aren't building your next feature. This is the risk of the "Product Focus Ratio" flipping against you.

Data Liquidity: If you are doing a data swap, you are exposing proprietary assets. In my experience with Audience Town, understanding the liquidity of data—how easily it can be used or resold by the partner—is critical. You aren't just giving them "rows in a spreadsheet"; you are giving them intelligence.

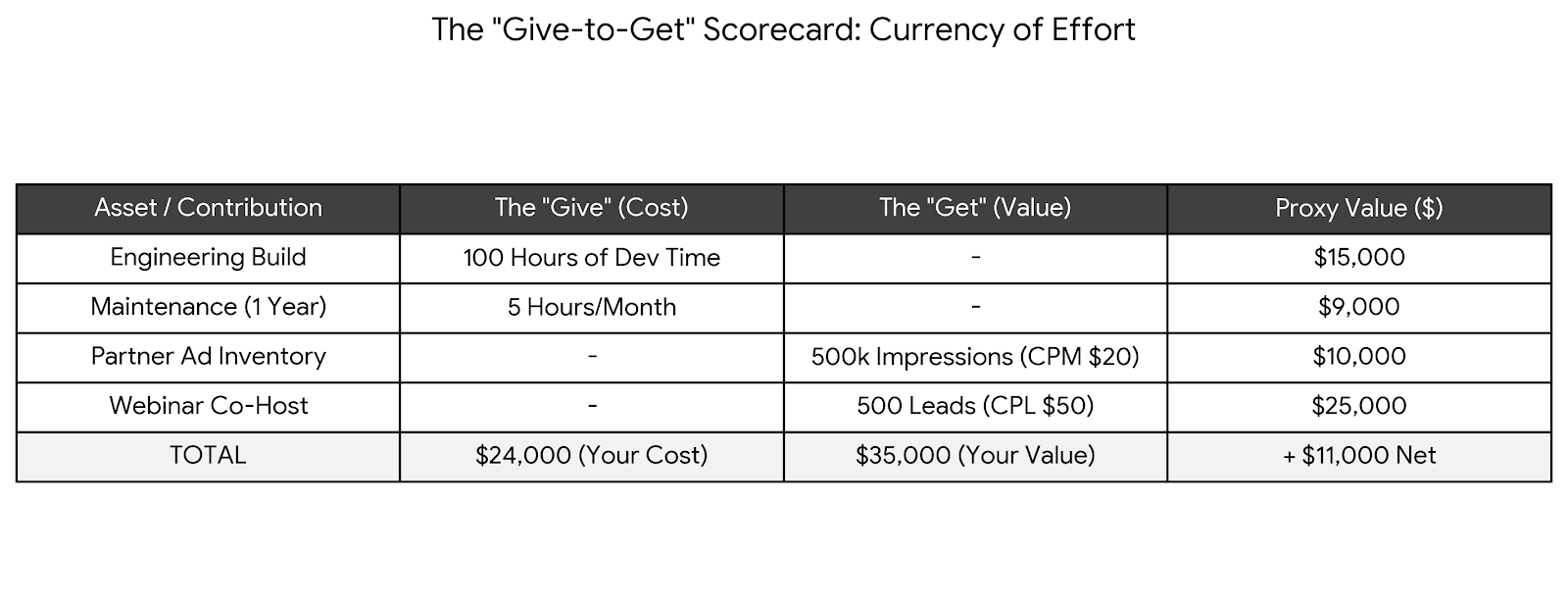

The "Currency of Effort" Scorecard

So, how do you actually negotiate this? You can't walk into a meeting and say, "My engineering time is worth more than your email blast." You need a common language.

This is where the Currency of Effort Scorecard comes in.

Since no cash is changing hands, you need to convert everything into a normalized unit. I recommend converting both "Engineering Hours" and "Marketing Impressions" into a proxy dollar value to see if the scales balance.

Here is a simplified example of how I structure this analysis:

| Asset / Contribution | The "Give" (Cost) | The "Get" (Value) | Proxy Value ($) |

|---|---|---|---|

| Engineering Build | 100 Hours of Dev Time | - | $15,000 |

| Maintenance (1 Year) | 5 Hours/Month | - | $9,000 |

| Partner Ad Inventory | - | 500k Impressions (CPM $20) | $10,000 |

| Webinar Co-Host | - | 500 Leads (CPL $50) | $25,000 |

| TOTAL | $24,000 (Your Cost) | $35,000 (Your Value) | + $11,000 Net |

Quick Give-to-Get Calculator

Adjust proxies to preview the estimated Give, Get, and Net position for a potential deal.

Estimated Give ($): $0

Estimated Get ($): $0

Net: $0

This is a simple heuristic — adjust proxies to match your organization's burdened rates and conversion assumptions.

In this scenario, the deal is positive. You are "spending" $24k in effort to get $35k in value.

But what if the ratio was reversed? What if you were spending $50k in dev time for $10k in exposure?

In that case, the deal is structured as "Debt". The partner is effectively in debt to you. To balance the ledger, they must "pay down" that debt. Since they aren't paying cash, they must pay in other assets: increased data access, more aggressive placement on their marketplace, or a longer commitment term.

The rule of thumb is simple: If the ratio isn't 1:1 (+/- 20%), re-negotiate.

Valuing the Invisibles: Data Integrity & Tech Lift

One of the most overlooked aspects of non-monetary partnership agreements is the hidden technical value.

When I was evaluating partnerships with SSPs and DSPs, we often looked at the obvious metrics: volume, fill rate, CPM. But the real value often lay in the integration itself.

PartnerStack notes a fascinating "sneaky benefit" of integration partners: your APIs get better. When you open your system to a third party, they will stress-test your code in ways you never imagined. They will find bugs you didn't know existed.

This "Tech Lift" has value. If a partnership forces you to clean up your documentation and harden your security, that is a net positive for your organization, even if the marketing leads are slow to arrive.

Similarly, consider Data Liquidity. In the programmatic space, data is currency. If you are entering a "Data-for-Inventory" swap, you need to value your data not just by quantity, but by uniqueness. First-party audience insights are rare and depreciating assets. If you give them away, you dilute their value.

Always ask: Is the data I'm receiving as liquid and valuable as the data I'm giving? If you are giving specific user intent data (high value) and receiving generic demographic data (low value), the exchange rate is wrong.

The Pre-Nup: Planning for the Divorce

It’s uncomfortable to talk about the end of a partnership before it even begins. Most business development professionals are optimists; they plan for the wedding, not the divorce.

But in non-monetary deals, the exit is where the biggest fights happen.

If you build a custom integration and the partnership dissolves, who owns the code?

If you co-mingled data to create a shared audience segment, who gets to keep that segment when the contract ends?

Expert insights from Wharton Executive Education suggest that you must identify your strategy—Window, Option, or Positioning—early on. This strategic clarity dictates your exit clause.

A "Fair Value Exchange" must include a pre-nup. It should explicitly state:

- Code Ownership: "Upon termination, Partner A retains rights to the API adapter, while Partner B must remove all access tokens within 30 days."

- Data Sunset: "All shared data segments must be deleted from Partner B’s servers upon contract expiry."

Without these clauses, you risk a situation where a former partner continues to benefit from your hard work (your "Give") long after you have stopped receiving any value (their "Get").

Case Study: The "Lopsided" Correction

Let’s look at a hypothetical scenario that mirrors many of the "Zombie Partnerships" I’ve seen in the industry.

The Players: TechCo (Small): An agile MarTech platform with a great product but low brand awareness. LegacyBrand (Giant): A massive, slow-moving industry incumbent with a huge customer base.

The Deal: LegacyBrand wants TechCo to build a custom integration so their legacy systems can talk to TechCo’s modern tool. In exchange, LegacyBrand offers to list TechCo on their "Preferred Partner" marketplace.

The Expectation: TechCo thinks, "This is it! We’re going to get access to millions of customers." They agree to the heavy lifting.

The Reality (6 Months Later): TechCo has spent 200+ engineering hours building and fixing the custom integration because LegacyBrand’s documentation was outdated. LegacyBrand listed TechCo’s logo on a buried page of their website. Traffic sent? Zero. LegacyBrand is happy—they got a modern feature for free. TechCo is drowning in technical debt.

The Fix: If TechCo had applied the Give-to-Get framework, they would have seen the red flags immediately. The Give: $30,000 worth of engineering time (High). The Get: A logo placement with an estimated click-through rate of 0.01% (Low). The scorecard would have shown a massive deficit. TechCo could have used this data to negotiate before signing. They could have demanded: "We will build this integration, but only if you commit to a dedicated email blast to your top 10% of customers and a featured webinar." By monetizing their effort, they would have forced the "Giant" to put real skin in the game.

Takeaways

Partnerships are powerful. For high-maturity companies, they can drive up to 28% of total revenue. Companies that successfully leverage partner models can see their valuation multiples jump from 1x to 10-20x revenue.

But this growth is reserved for leaders who treat partnerships with the same financial rigor as a P&L.

The days of "handshake barter deals" are over. If you want to build a scalable ecosystem, you must respect the value of your own resources. You must count the cost of your engineering hours, value your data like cash, and ensure that every non-monetary partnership agreement has a fair exchange rate.

Don't settle for "free." Settle for fair.

Struggling to value a potential integration or data partnership? I help organizations build "Partnership P&Ls" that protect engineering resources and maximize ROI. If you want to stop trading blind and start building equity, let’s chat.